RTL Group’s strategy is built on three priorities: core, growth, and alliances and partnerships.

The international media industry is in the middle of a fundamental transformation, with huge opportunities for those prepared to shape the future.

RTL Group transforms its business for higher reach and better monetisation to unlock these opportunities. Combining linear TV channels and non-linear services increases total reach and requires investments in content, marketing and state-of-the-art streaming services. Targeting, personalisation and recommendation improve the monetisation of that reach, and require investments in advertising technology and data.

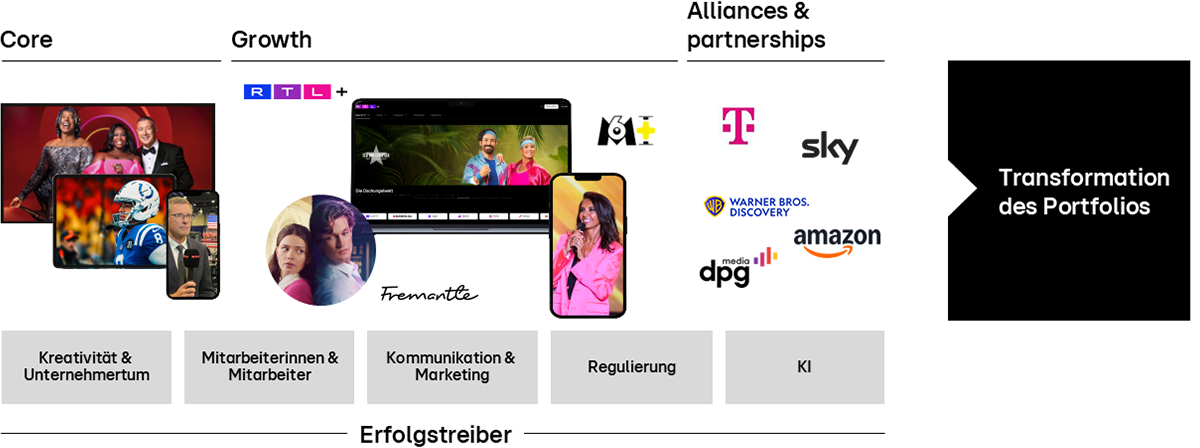

RTL Group’s Board of Directors and Executive Committee have defined a strategy that builds upon three priorities:

- Strengthening the Group’s core

- Expanding RTL Group’s growth businesses, in particular in the areas of streaming, content production and technology.

- Fostering alliances and partnerships in the European media industry.

Wherever attractive opportunities arise, the Group aims to consolidate across its existing European broadcasting footprint – including mergers and acquisitions. The strategic rationale is about scale, pooling resources and creativity to compete with global tech platforms in the respective national markets. In Belgium, Croatia and the Netherlands, RTL Group decided to sell its TV and streaming businesses to regional media companies so they can act as consolidators in these markets.

In June 2025, RTL Group announced that it had signed a definitive agreement to acquire Sky Deutschland (DACH). The transaction brings together two of the most recognisable media brands in the DACH region, creating a future-ready entertainment business with around 12 million paying subscribers. This is RTL Group’s largest transaction since its inception in 2000: RTL Group’s pro forma revenue will increase by more than 30 per cent to €8.0 billion (based on 2025). The combined business will offer a broader, more compelling German-language content portfolio for consumers. Viewers will benefit from expanded access to premium live sports, entertainment and news across RTL+, Sky, WOW and RTL’s free-to-air channels. By bringing together the strengths of RTL and Sky, the combined company will be able to compete against global streaming platforms. The transaction is subject to regulatory approvals and expected to close in the first half of 2026.

Building and extending families of TV channels addresses increasing audience fragmentation and competition in a digital, multi-channel world, with the aim of maintaining or growing RTL Group’s linear audience shares and net TV advertising market shares in the countries in which it operates. In recent years, RTL Group’s families of channels have been extended by digital channels, including Nitro, RTL Up, Vox Up and 6ter.

To further strengthen its broadcasting business, RTL Group aims to increase non-advertising revenue. This includes growing revenue from platform operators – cable network operators, satellite companies and internet TV providers – for services such as high-definition TV channels, streaming services and digital pay-TV channels (distribution revenue).

Investing in premium content and exploring all ways to develop and own new hit formats are key to strengthening RTL Group’s core business. In 2025, RTL Group spent around €4 billion on content, combining the programming spend of its broadcasters and the productions of its global content business, Fremantle. Investment in local, exclusive content – including the rights for live sports events – strengthens RTL Group’s linear TV channels, streaming services, and news and magazine formats.

The following deals strengthen the Group’s linear channels – helping to attract primarily male audiences – and play an important part in gaining new paying subscribers for the Group’s streaming services:

Germany

- Highlight rights for the German football league (Bundesliga and 2. Bundesliga) for RTL+ for four seasons starting from 2025/26

- Free-TV rights for the weekly top match of the second league (2. Bundesliga) for the four seasons 2025/26 to 2028/29

- Uefa Europa League and Europa Conference League for the seasons 2024/25 to 2026/27

- Half of all football matches of the German national team in the Uefa Nations League until 2028

- European Qualifiers for both the Fifa World Cup 2026 and Uefa Euro 2028

- German Cup rights for a total of 15 matches from seasons 2026/27 to 2029/30 for live TV, including highlight rights on live TV and RTL+

- National Football League (NFL) matches, including the Super Bowl, until 2028

- More than 15 Mixed Martial Arts (MMA) fights per year from 2025 to 2027

- Content partnership with Sky Deutschland: seven Formula 1 races broadcast live on RTL in Germany, alongside one game from the English Premier League per match week on RTL+. The partnership also includes selected highlights rights and Sky fiction productions.

- Content partnership with Warner Bros Discovery from 2025 to 2035, including feature and library films for linear TV and streaming, and first-run series for streaming

- Exclusive five-year deal with German entertainer and TV producer Stefan Raab for linear television programmes and formats on RTL+

France

- Most of the matches of the Fifa World Cup in 2026 and 2030 – a total of 54 matches for each tournament

- Free-to-air TV rights of the Uefa Champions League finals in 2025, 2026 and 2027

- Exclusive broadcasting rights for the Fifa Women’s World Cup 2027

- Talent deal with French entertainer Cyril Hanouna for the daily show Tout beau, tout n9uf on W9 and Tout beau, tout Fun on Fun Radio

Others

- Hungary: Uefa Champions League starting in the 2024/25 season for three years

- Hungary: retained linear and digital rights to the Uefa Europa League and the Uefa Europa Conference League for three years for the seasons 2024/25 to 2026/27

- Luxembourg: Uefa Champions League until 2028

- Luxembourg: Uefa European Qualifiers until 2028

- Luxembourg: Formula 1 races until 2026

RTL Group’s management continuously reviews the Group’s portfolio. In previous years, RTL Group sold several non-core assets – including the football club Girondins de Bordeaux and the website MonAlbumPhoto in France, the home entertainment and theatrical distribution company Universum Film in Germany, the digital video network BroadbandTV (BBTV) based in Canada, the ad-tech company SpotX, the mobile entertainment company Ludia and the software and data company for media measurement, VideoAmp – all in the US. In 2025, RTL Deutschland sold its magazine brands Brigitte, Gala and Eltern, and the digital food and recipe platform Chefkoch.

These disposals are consistent with RTL Group’s strategy to focus on growing its European digital businesses in the areas of streaming and advertising technology, alongside the Group’s global content business, Fremantle.

RTL Group is building national streaming champions in the European countries where it has leading families of TV channels. These streaming services capitalise on the Group’s competitive advantage in local programming to complement global services such as Netflix, Prime Video and Disney+.

RTL Group operates the services RTL+ in Germany and Hungary and M6+ in France – all of which have gradually introduced a hybrid business model consisting of various price packages. Lower-priced or free packages are predominantly or fully financed by advertising. Various premium price packages include parallel streams on various devices, the live signal of RTL TV channels in HD quality and premium content bundles. These content bundles offer programmes from the Group’s linear TV channels in the respective countries, plus premium content either exclusively produced or licensed from third parties.

By the end of 2025, RTL Group had 8.060 million paying subscribers for its streaming services RTL+ in Germany and Hungary and M6+ in France – up 19.2 per cent year on year (end of 2024: 6.764 million).

In July 2024, RTL Group announced that its largest streaming service, RTL+ in Germany, plans to migrate to the Bedrock technology platform. This plan is in line with RTL Group’s strategy to deepen Group-wide cooperation in technology, advertising sales and content. The migration is expected to be completed by the end of April 2026, which will generate significant cost savings and increase its innovation strength. The migration will contribute to RTL Group’s goal of reaching profitability with its streaming businesses in 2026 and to further grow Bedrock.

In March 2024, Groupe M6 announced additional investments of €100 million annually in M6+ for content, technology and marketing, ramping up over three years. The service is primarily financed by advertising (AVOD), complemented by a premium subscription tier (SVOD). M6+ runs on the technology platform provided by Bedrock and was launched on 14 May 2024. Since its launch, M6+ has experienced strong momentum in France, significantly accelerating its audience growth and engagement compared to its predecessor 6play.

RTL Hungary launched its streaming service RTL+ in November 2022. The service offers exclusive local content – a unique feature in the Hungarian streaming landscape – also based on Bedrock technology. From 1 January 2025, Hungarian integrated service provider 4iG Group, together with its telecommunications subsidiaries, started to distribute all linear TV channels of RTL Hungary and exclusively distribute the streaming service RTL+.

RTL Group’s content business, Fremantle, is one of the world’s largest creators, producers and distributors of scripted and unscripted content. Fremantle runs an international network of teams across production and distribution in 28 countries. The company is responsible for more than 11,000 hours of programming each year, and distributes content worldwide.

Fremantle continues to target acquisitions of small and medium-sized production companies and partnerships with creative talent.

Following a strategy review in 2025, Fremantle defined five strategic priorities:

- Ramp up of own IP development: Long-running formats and strong intellectual property are the foundation of sustainable value creation in the content business. Building on Fremantle’s proven track record in developing and globally scaling successful format brands, RTL Group will further strengthen and expand Fremantle’s proprietary IP portfolio.

- Rapid AI deployment across the value chain: Over the past two years, Fremantle has assessed the application of AI across the content development and production value chain. Following successful pilots demonstrating significant productivity potential, AI is now being systematically deployed to enhance efficiency and creative processes.

- Focus on IP-driven small to medium-size M&A: Given the limited scale benefits associated with large mergers in the content production sector, RTL Group will continue to pursue a disciplined, IP-driven acquisition strategy focused on small and medium-sized production companies.

- Expansion into attractive geographies and genres: Targeted acquisitions will support the expansion of Fremantle’s presence in attractive geographies and high-growth genres, further diversifying its creative capabilities and revenue base.

- Continued cost discipline and operating leverage: By scaling the organisation with continued cost discipline and leveraging AI, RTL Group aims to increase Fremantle’s Adjusted EBITA margin to approximately 9 per cent by 2026.

Fremantle has been investing in high-end productions to accelerate its growth in drama series, films and documentaries. Acquisitions include, for example, Miso Film in Scandinavia, This is Nice Group in the Nordics, Wildside and Lux Vide in Italy, Asacha Media Group and Kwaï in France, A Team Productions in Belgium, Silvio Productions in Israel, Dancing Ledge Productions, 72 Films and Wildstar Films in the UK, Passenger in the US, Eureka in the US and Australia, Element Pictures in the UK and Ireland and Beach House Pictures in Asia.

Fremantle also bought minority stakes in a number of new production companies to secure first access to their creative talent and output. Working with world-class storytellers is key to Fremantle’s scripted strategy.

Combining the strengths of RTL Group’s core business – high reach, brand safety and emotional storytelling – with data and targeting offers growth potential for the Group’s largest revenue stream: advertising. Addressable TV will grow the available inventory, attract new advertisers and can be sold at a premium compared to traditional linear TV advertising.

RTL Group’s largest unit, RTL Deutschland, is responsible for the Group’s ad-tech business, Smartclip. Based on Smartclip technology, RTL aims to create an open ad-tech platform tailored to the needs of European broadcasters and streaming services. Accordingly, RTL Deutschland will invest further in evolving and growing the Smartclip platform.

Bedrock, a French technology company co-founded by RTL Group and Groupe M6, builds the tech platform for Groupe M6’s streaming service M6+, Videoland in the Netherlands and RTL+ in Hungary, with RTL+ in Germany to be fully migrated by the end of April 2026. This common platform allows RTL Group to bundle streaming technology investments.

In competing with the global tech platforms, new alliances and partnerships between European media companies become increasingly important.

In autumn 2019, RTL Group’s management started to promote new partnership opportunities – all based on the philosophy of bundling European broadcasters’ resources to establish open and neutral platforms. RTL Group offers these partnership opportunities in areas such as advertising sales, advertising technology, streaming technology, content creation and data.

As part of the sale of RTL Nederland, RTL Group and DPG Media have entered a partnership, spanning from technology to advertising sales and content. With the closing of the transaction on 1 July 2025, the service agreements for RTL Nederland in the areas of streaming technology (via Bedrock), broadcasting operations (via RTL Group’s technical services provider BCE) and international advertising sales (via RTL AdAlliance) were renewed for at least three years. RTL Nederland also continues to use the solutions provided by RTL Group’s ad-tech business, Smartclip.

In January 2025, Deutsche Telekom and RTL Deutschland announced the renewal of their streaming partnership – which started at the end of 2020 – until 2030. Under the terms of the agreement, RTL+ Premium is included in most price plans of Deutsche Telekom’s TV offer, Magenta TV, without additional fees for Magenta TV customers. Renewing the successful cooperation between Deutsche Telekom and RTL Deutschland for another five years contributes significantly to RTL Group’s strategic streaming goals.

In October 2025, RTL Deutschland and Amazon expanded their partnership by launching RTL+ as a dedicated add-on channel on Prime Video in Germany and Austria. Amazon customers can now easily access the full streaming portfolio of RTL+ directly via Prime Video for €12.99 per month, without advertising or app switching. The partnership enhances RTL Deutschland’s market reach. In January 2026, Groupe M6 entered into a distribution agreement with Amazon Prime Video to make its streaming service M6+ available to all Prime members in France at no additional cost. Through a dedicated M6+ section, Prime members can access live and on-demand content from M6, W9, 6ter and Gulli, as well as platform-exclusive programming, representing more than 30,000 hours of content. The partnership expands the reach and visibility of Groupe M6’s brands and strengthens the distribution of its advertising offering.

In November 2025, Groupe M6 announced that its advertising division, M6 Unlimited (previously M6 Publicité), has become a launch partner of Amazon Publisher Cloud in France – an innovative ad-tech and data collaboration platform developed by Amazon Ads. The partnership combines Groupe M6’s audience data with Amazon’s shopping and behavioural insights to deliver more relevant and effective advertising, while fully preserving user privacy. As a result, Groupe M6 can further enhance its audience monetisation and targeting capabilities across its streaming service M6+.

In January 2026, RTL Deutschland announced a streaming partnership with Warner Bros Discovery to launch a bundled subscription combining RTL+ and HBO Max in Germany, coinciding with the German market entry of HBO Max. The offer unites the strong local content portfolio of RTL+ with HBO Max’s internationally renowned series and films, providing subscribers with access to both platforms through a single, monthly cancellable subscription. The bundle is available in two tiers – an entry-level package with advertising and a premium ad-free option – both offering a price discount compared to standalone subscriptions. In February 2026, the bundle was also launched in Austria.

In December 2024, Smartclip and M6 Unlimited, the advertising sales house of Groupe M6, announced a strategic technology partnership. Smartclip’s advanced ad-tech solutions will progressively be integrated into M6 Unlimited’s ad-tech stack, supporting Groupe M6’s ambition to triple its streaming revenue to €200 million by 2028 compared to 2023.

One key development for RTL Group’s largest revenue stream – advertising – has been the increased demand from advertisers and agencies for global ad-buying opportunities. Consequently, RTL Group is expanding international advertising sales to cater to the demand from international advertisers and agencies for easy access to the Group’s large portfolio of TV and streaming services, its social media company and advertising technology in a brand-safe environment.

In 2022, RTL Group combined RTL AdConnect, G+J iMS and the media division of Smartclip to create an international advertising sales champion: RTL AdAlliance. RTL AdAlliance provides international advertisers with simplified access to a unique total video portfolio of media brands across linear TV, addressable and connected TV and online video.

In October 2024, RTL Group’s international sales house, RTL AdAlliance, announced that the multi-channel sales house IP Österreich – now a 100-per-cent subsidiary of RTL Group – will fully become part of RTL AdAlliance and merge its portfolio from July 2025 onwards. Advertising clients in Austria benefit from the advertising inventory of well-known European media brands and the premium content of RTL AdAlliance.

In September 2025, RTL AdAlliance, RTL Group’s international advertising sales house, signed an exclusive cooperation agreement with FranceTV Publicité, the sales house of France Télévisions. RTL AdAlliance represents the TV and digital inventory of France Télévisions internationally, further strengthening its role as a central platform for brand-safe, transparent and European-based media offerings. In October 2025, RTL AdAlliance launched a strategic advertising sales partnership with ORF-Enterprise, the advertising sales house of Austria’s public broadcaster ORF. RTL AdAlliance represents the TV, radio and digital inventory of ORF internationally.

On a national level, the German Ad Alliance launched in 2016, offering high reach to advertisers and agencies. Ad Alliance in Germany is a one-stop shop for the development of cross-media solutions and innovative advertising products. Its portfolio spans television, radio/audio, print and digital. Ad Alliance is the only sales house in Germany that offers complex, all-media campaigns from a single source. In 2019, the sales house Media Impact (Axel Springer) became a partner of Ad Alliance, and from January 2024, Ad Alliance has taken over the advertising sales of the digital portfolio of Bauer Advance. The partnership includes all digital brands of the Bauer Media Group and is a further step towards RTL Group’s envisaged ad sales consolidation. As of January 2026, Ad Alliance has taken over advertising sales for HBO Max in Germany. Together, the platforms of Ad Alliance reach 99 per cent of the German population. Ad Alliance remains open to additional partnerships.

Oliver Fahlbusch

Executive Vice President Communications & Investor Relations, RTL Group

+352 / 24 86 5200